All Categories

Featured

Table of Contents

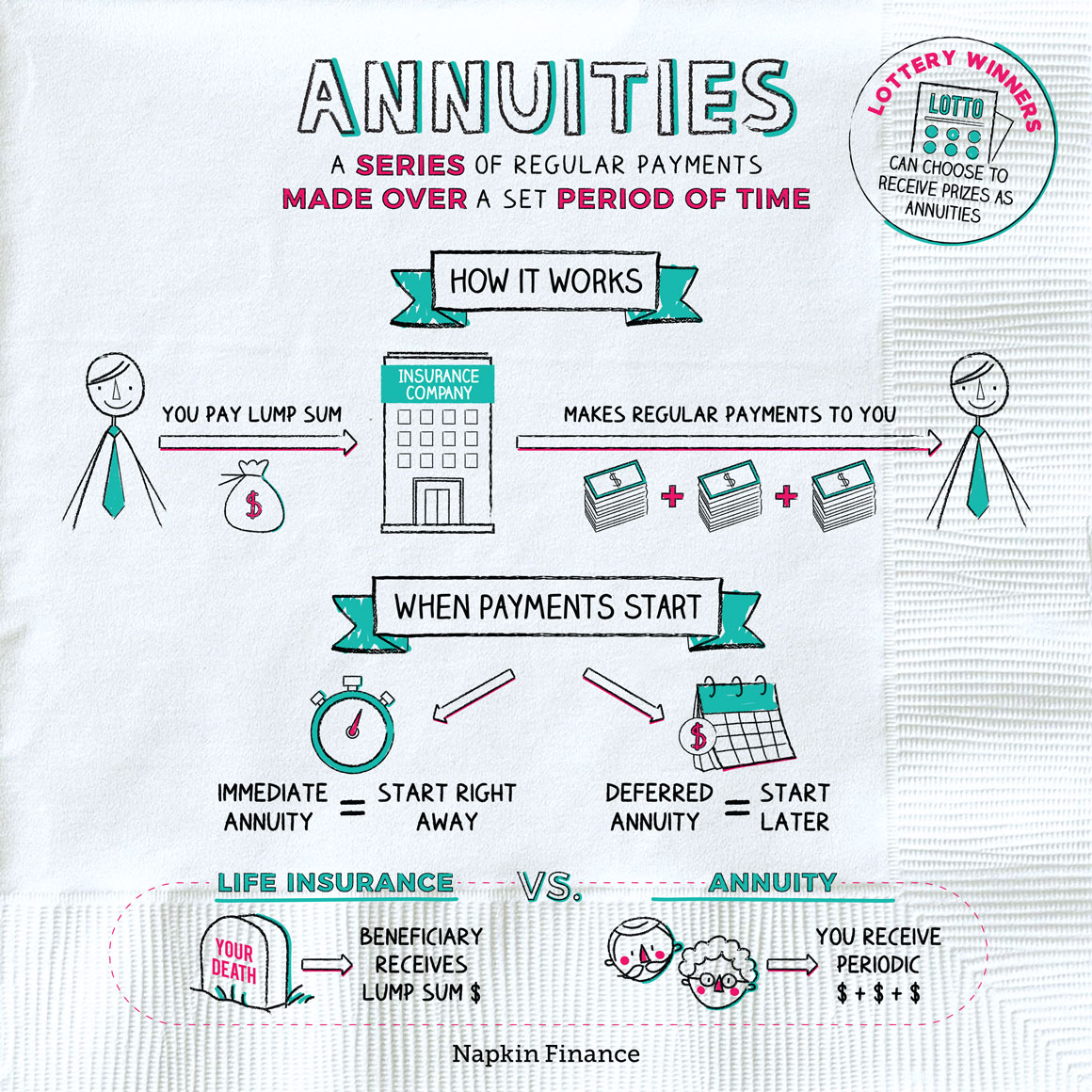

: Annuities can use guaranteed income for life. Annuities do not. Due to the fact that they're invested in a different way, annuities commonly supply a higher guaranteed price than various other items.

You will not pay taxes on the rate of interest you earn till you're all set to begin getting revenue from your annuity. You pay tax obligations when you obtain your annuity income, and no person can predict what the taxed price will go to the time. Annuities can be tough to recognize. You'll intend to collaborate with an expert you count on.

Deferred Annuities

Deposits into annuity contracts are normally secured for a time period, where the annuitant would incur a charge if all or component of that cash were taken out. Each kind of annuity has its own special advantages. Finding out which one is best for you will certainly rely on variables like your age, risk tolerance and exactly how much you need to spend.

This item is a blend of its taken care of and variable relatives, which makes it a little bit a lot more complex. The passion rate paid to annuitant is based upon the efficiency of a defined market index. With an indexed annuity, you have the chance to gain higher returns than you would with a fixed annuity with more security against losses than with a variable annuity.

Deferred Annuities

Due to the fact that of their complexity, the decision to buy an annuity is one you should go over with a specialist. Since you understand what an annuity is, get in touch with your neighborhood Farm Bureau representative or advisor to comprehend your alternatives and create a retired life technique that benefits you. Acquiring one can help you feel a feeling of financial safety and security in retirement. One benefit to annuities is the truth that they can give guaranteed income for an established number of years, or also for the rest of your life.

As a matter of fact, in these conditions, you can think of an annuity as insurance coverage versus potentially outliving your cost savings. For workers who don't get a pension plan, an annuity can help load that space. Employees can spend cash into a retirement account (like an IRA) and after that, upon retirement, take those financial savings and purchase an annuity to supplement Social Protection.

Who should consider buying an Flexible Premium Annuities?

One more huge benefit provided by annuities? The money you contribute expands tax-deferred. This indicates you do not pay tax obligations on the rate of interest until you start getting the funds, generally after you begin retired life. All certified annuity withdrawals undergo regular earnings tax obligation, and withdrawals taken prior to the age of 59 will incur an added 10% tax fine The tax-deferred condition can permit your money to have even more growth potential or permit your cash to potentially grow even more in time due to the fact that made rate of interest can compound with no funds needing to approach tax payments.

Unlike other retirement choices, there are no internal revenue service limitations on the quantity of cash you can add to an annuity. The IRS locations caps on the quantity you can buy an IRA or 401(k) each year. The 2024 restriction for an Individual retirement account is $7,000 a year or $8,000 if you're 50 or over.

What is the best way to compare Annuity Interest Rates plans?

1 However the internal revenue service does not position a ceiling on the amount you can contribute to an annuity. After you have actually maxed out your 401(k) and IRA payment amounts, if you still want to save even more for retired life, an annuity may be a good option to consider. Annuities can be found in all sizes and shapes.

There are immediate annuities and deferred annuities. What this implies is you can either buy an annuity that provides settlement within a year of your costs or an annuity that starts paying you in the future, usually upon retirement. There are also annuities that expand at a fixed rate, or variable annuities that grow according to the performance of financial investments you have in a subaccount.

This is an area where annuity benefits might offer proprietors an advantage. With an annuity, you might have an alternative to buy a rider that permits you to get greater settlements for a set time period if you require long-lasting treatment.

It's only a guaranteed quantity of earnings you'll obtain when the annuity enters the payout phase, based on the claims-paying capability of the insurance provider. With any financial decision, it's excellent to understand and weigh the costs and advantages. If you need to know what are the advantages of an annuity, remember it's a practical choice to save tax-deferred cash for retirement in a way that matches your demands.

What types of Secure Annuities are available?

Lots of people pick to start receiving these settlements either at or at some point after retirement - Variable annuities. Annuities have an entire host of names, based on advantages and providing companies, but at their core, they are best recognized by their timeline (instant or delayed) and whether they include market exposure (variable). A prompt annuity allows you promptly transform a lump amount of money right into a guaranteed stream of income.

Table of Contents

Latest Posts

Analyzing Annuities Variable Vs Fixed A Closer Look at How Retirement Planning Works What Is Fixed Annuity Vs Variable Annuity? Advantages and Disadvantages of Different Retirement Plans Why Variable

Highlighting Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Annuity Fixed Vs Variable Breaking Down the Basics of Deferred Annuity Vs Variable Annuity Benefits of Choosin

Analyzing Immediate Fixed Annuity Vs Variable Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Variable

More

Latest Posts